Inspire client trust by delivering clear, insightful investment communications

One of the best ways to build trust is to consistently deliver clear, insightful investment communications. This brief article will tell you how to accomplish that most effectively utilizing your quarterly performance report and your off-cycle investment communications.

Begin by recognizing that although data is essential, data alone is not sufficient.

Without a comprehensive analysis that describes how your firm has delivered for clients, even data-rich quarterly performance reports produce limited benefits.

I learned about the power of investment reporting and communications during my tenure as director of marketing for the fund analysis and research group at Fidelity Management and Research Company. Our role was to support Fidelity’s internal investment consultants as they diligently kept the firm’s intermediary and institutional clients informed about Fidelity’s funds.

In this role, I saw firsthand how clear and insightful analytical assessments of overall portfolio performance build high levels of client trust that withstand the test of time. Your high-net-worth clients will appreciate the same kind of accurate, informative, and transparent communications from you, and they will give you their loyalty in return.

To set the stage, write a cover letter that presents a meaningful context.

Your quarterly report’s cover letter should be a synopsis of your story. I liken it to a set of Cliff Notes. After reading the cover letter, your clients should easily discern the following:

- What you consider to be the top two or three market and economic events that quarter

- All significant or deliberate changes to asset allocation

- Any changes to positions, including reasons for the changes

- Performance for the entire portfolio, net of your fees, and how that compares to corresponding benchmarks

- Highlights of what contributed to or detracted from overall investment return

Review your cover letters to make sure they address all five of these points.

Explain performance against expectations.

It’s often a challenge for investors to easily understand the role of specific funds in their portfolios and how they should expect them to perform in various market environments. Differentiate yourself from other financial advisors by providing the following explanations in your quarterly report:

- How each fund performed against your expectations, as well as against your stated benchmarks. (Did the fund fulfill its intended role?)

- Why fund performance exceeded or fell short of expectations, considering the recent quarter’s market environment. (What are the drivers of over- or under-performance, and do those drivers fit with your expectations for how the fund is managed?)

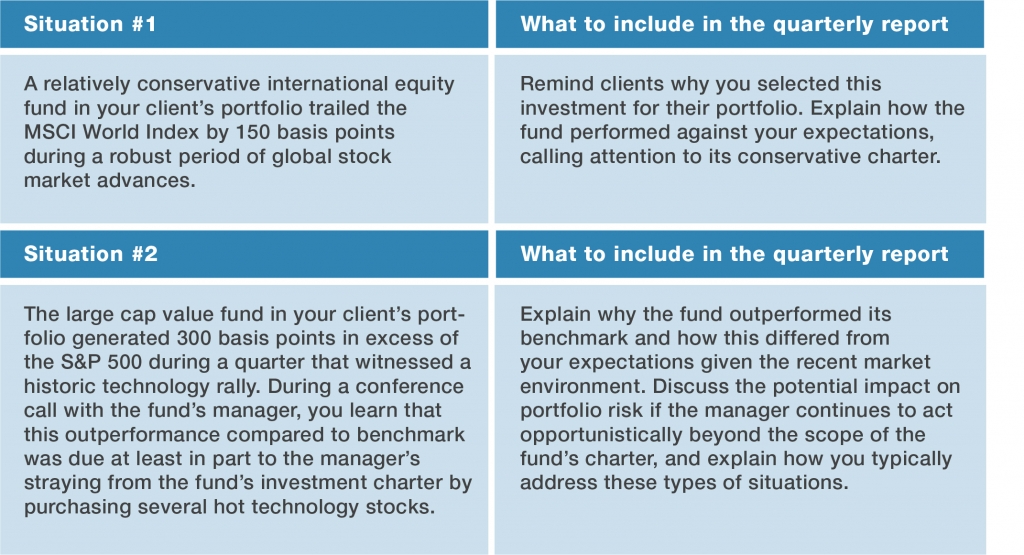

Below are two hypothetical situations that will help you better understand how to build trust with clients by explaining performance.

Make it easy for clients to interpret data.

Utilize pie charts, well-designed tables, and clear graphics to help your clients follow your stories. When comparing results against benchmarks, show the differences between the two (e.g., +3 percent, -1 percent) along with the actual comparisons. Your client should not need to pull out a calculator to get the underlying message.

Use the delivery of client reports to demonstrate your commitment to the relationship.

One week before sending out reports, contact your top clients to schedule conversations about the results. This provides three benefits:

- It demonstrates that you care.

- It builds trust through open and transparent communications.

- It gives you an opportunity to assess their needs.

Use off-cycle investment communications to further enhance trust.

- Deliver monthly educational pieces that communicate your point of view. Avoid reiterating market commentary that clients can easily learn from the media. Instead, deliver thoughtful educational pieces on investment topics relevant to your clients, such as the pros and cons of ETFs, strategies for managing investments during inflationary times, and when to use hedge funds.

Send these pieces via email in a PDF file format. Encourage clients to share your thought leadership with their friends and family members who may want to learn more about your services.

- Formally and consistently communicate with your clients about all new funds you plan to include in the client portfolio. Explain your top three reasons for adding each new fund and your expectations for performance.

- Contact clients in advance of any major portfolio shifts. Most people dislike surprises, so inform them of the changes and the reasons for them before taking actions.

The recommendations in this article will entail some additional work and commitment of time in the short term. But over the long term, they will engender greater trust from your clients, which will in turn result in greater sustainable profitability for your firm.

© 2024 Excella, Inc. This content cannot be reproduced without the express written consent of Excella, Inc. and Ani Yessaillian.